Scam alert for investors: How to spot unlicensed, fake firms in UAE

Investor alerts about firms impersonating well-known exchanges are becoming more frequent in the UAE, with official channels warning potential investors to avoid falling prey to scams.Recently, the UAE’s Capital Market Authority (CMA) warned investors against doing business with firms before verifying their licensing status. Before that, on February 2, it alerted investors of an unlicensed marketing firm and urged not to conduct business with them.In the UAE, any entity that offers investment services, manages funds, or markets financial products to the public must be licensed.Stay up to date with the latest news. Follow KT on WhatsApp Channels.The CMA, previously known as the Securities and Commodities Authority, regulates such activities on the UAE’s mainland. It recently updated its legal framework under new federal decree-laws that govern capital markets, strengthening oversight and investor safeguards.As fraudsters grow more sophisticated, regulators, particularly CMA, are urging the public to verify these companies before taking any further step.Start with the regulator’s registerThe most important step investors can take is to confirm that a firm is licensed. The CMA’s official website provides open data on licensed and registered companies, including brokerage firms, investment managers, and financial advisers.Before transferring funds or sharing personal documents, investors should search the CMA’s public register carefully to ensure the company’s name, licence number and contact details match exactly. Fraudsters often use names that closely resemble legitimate firms, changing only a word or adding a suffix such as “Global” or “International.” Even minor discrepancies in spelling, domain names or email addresses can signal an impersonation attempt.Understand which regulator appliesEach regulator publishes its own searchable database of licensed firms. Investors should always verify a company’s status directly through the official website of the relevant authority, rather than relying on links or documents provided by the firm itself.While the CMA regulates securities and investment activities on the UAE mainland, firms operating inside financial free zones are overseen by separate regulators.Companies based in the Dubai International Financial Centre are supervised by the Dubai Financial Services Authority, which maintains its own public register of authorised firms. Similarly, entities operating in Abu Dhabi Global Market fall under the Financial Services Regulatory Authority, the independent regulator for that financial free zone.Banks, finance companies and insurance providers across the country are licensed and supervised by the Central Bank of the UAE, which also oversees payment service providers and certain digital payment activities.For virtual asset and cryptocurrency businesses in Dubai, excluding the DIFC, oversight falls to the Virtual Assets Regulatory Authority. Given the rise in digital asset scams, investors should take extra care to verify whether a crypto platform holds the appropriate licence.Be wary of pressure tactics and guaranteed returnsImpersonating firms often rely on urgency and promises of high, “guaranteed” returns. UAE law prohibits misleading financial promotions and unauthorised investment activities. Any firm offering unusually consistent profits, risk-free trades, or exclusive time-limited opportunities should raise red flags.Cold calls, unsolicited WhatsApp messages and social media advertisements are also common tools used by scammers. Investors should be cautious about downloading unfamiliar trading apps or wiring funds to personal bank accounts, overseas accounts unrelated to the licensed entity, or cryptocurrency wallets.Report suspicions promptlyBoth the Capital Market Authority and the DFSA encourage the public to report suspected scams or unauthorised activities. Early reporting not only protects individual investors but also helps regulators issue public warnings and take enforcement action more quickly.UAE authority warns against dealings with unlicensed marketing firmMajor UAE bank warns of fraudsters posing as senior executives

Investor alerts about firms impersonating well-known exchanges are becoming more frequent in the UAE, with official channels warning potential investors to avoid falling prey to scams.

Recently, the UAE’s Capital Market Authority (CMA) warned investors against doing business with firms before verifying their licensing status. Before that, on February 2, it alerted investors of an unlicensed marketing firm and urged not to conduct business with them.

In the UAE, any entity that offers investment services, manages funds, or markets financial products to the public must be licensed.

Stay up to date with the latest news. Follow KT on WhatsApp Channels.

The CMA, previously known as the Securities and Commodities Authority, regulates such activities on the UAE’s mainland. It recently updated its legal framework under new federal decree-laws that govern capital markets, strengthening oversight and investor safeguards.

As fraudsters grow more sophisticated, regulators, particularly CMA, are urging the public to verify these companies before taking any further step.

Start with the regulator’s register

The most important step investors can take is to confirm that a firm is licensed. The CMA’s official website provides open data on licensed and registered companies, including brokerage firms, investment managers, and financial advisers.

Before transferring funds or sharing personal documents, investors should search the CMA’s public register carefully to ensure the company’s name, licence number and contact details match exactly. Fraudsters often use names that closely resemble legitimate firms, changing only a word or adding a suffix such as “Global” or “International.” Even minor discrepancies in spelling, domain names or email addresses can signal an impersonation attempt.

Understand which regulator applies

Each regulator publishes its own searchable database of licensed firms. Investors should always verify a company’s status directly through the official website of the relevant authority, rather than relying on links or documents provided by the firm itself.

While the CMA regulates securities and investment activities on the UAE mainland, firms operating inside financial free zones are overseen by separate regulators.

Companies based in the Dubai International Financial Centre are supervised by the Dubai Financial Services Authority, which maintains its own public register of authorised firms. Similarly, entities operating in Abu Dhabi Global Market fall under the Financial Services Regulatory Authority, the independent regulator for that financial free zone.

Banks, finance companies and insurance providers across the country are licensed and supervised by the Central Bank of the UAE, which also oversees payment service providers and certain digital payment activities.

For virtual asset and cryptocurrency businesses in Dubai, excluding the DIFC, oversight falls to the Virtual Assets Regulatory Authority. Given the rise in digital asset scams, investors should take extra care to verify whether a crypto platform holds the appropriate licence.

Be wary of pressure tactics and guaranteed returns

Impersonating firms often rely on urgency and promises of high, “guaranteed” returns. UAE law prohibits misleading financial promotions and unauthorised investment activities. Any firm offering unusually consistent profits, risk-free trades, or exclusive time-limited opportunities should raise red flags.

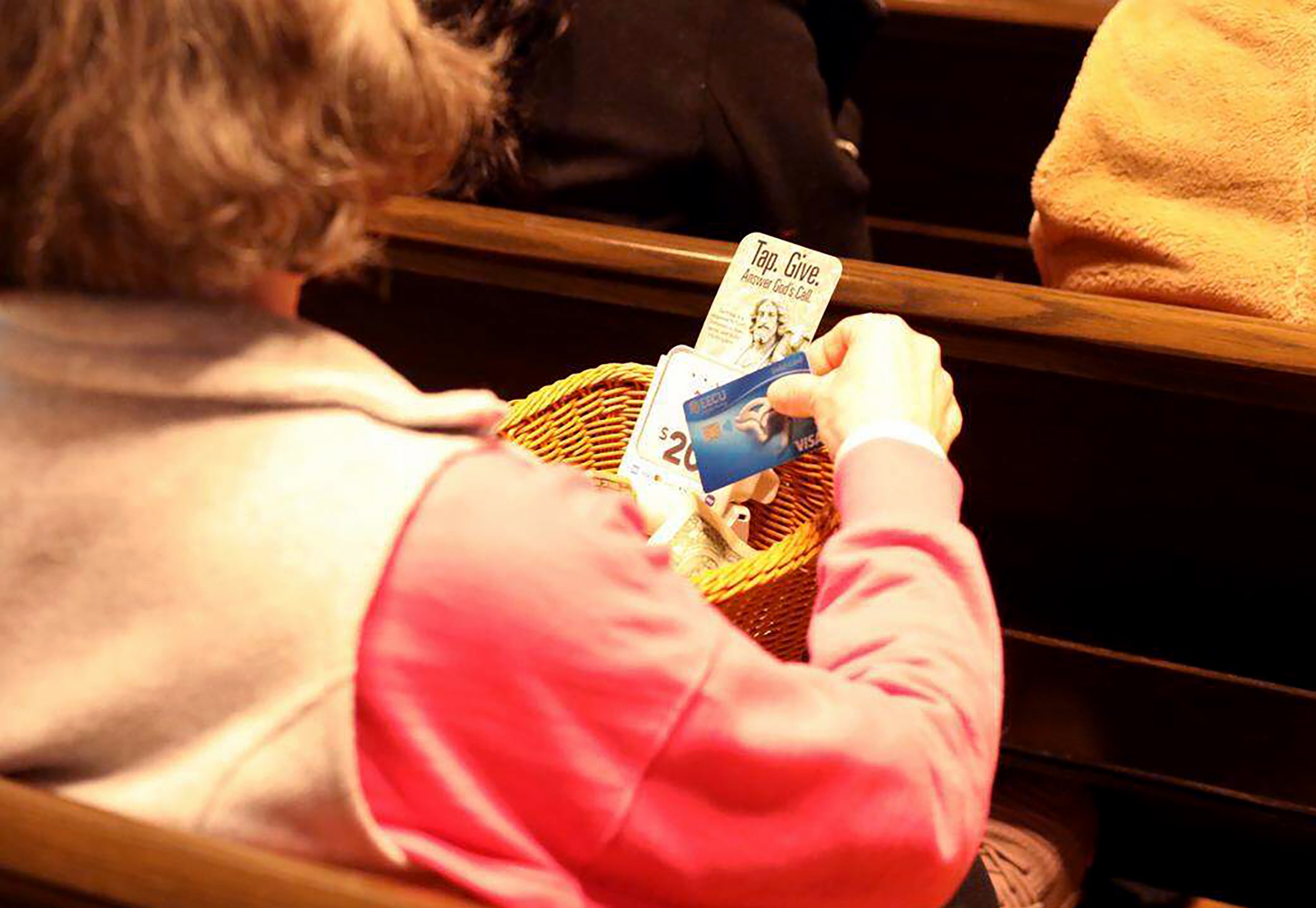

Cold calls, unsolicited WhatsApp messages and social media advertisements are also common tools used by scammers. Investors should be cautious about downloading unfamiliar trading apps or wiring funds to personal bank accounts, overseas accounts unrelated to the licensed entity, or cryptocurrency wallets.

Report suspicions promptly

Both the Capital Market Authority and the DFSA encourage the public to report suspected scams or unauthorised activities. Early reporting not only protects individual investors but also helps regulators issue public warnings and take enforcement action more quickly.

What's Your Reaction?