African start-ups secure $174mn in January

African technology ventures attracted $174 million in funding in January 2026, signalling a measured but steady start to the year for a sector navigating tighter global capital conditions. The figure, compiled by market intelligence platform Africa: The Big Deal, covers equity, debt and grant financing across the continent. The total marks a continuation of cautious investor behaviour that characterised much of the past two years, following the […] The article African start-ups secure $174mn in January appeared first on Arabian Post.

The total marks a continuation of cautious investor behaviour that characterised much of the past two years, following the record-breaking funding cycle of 2021 and the subsequent correction in 2022 and 2023. While January’s tally remains below the monthly peaks seen during the venture capital boom, it indicates sustained appetite for scalable African ventures in key sectors such as fintech, climate technology, logistics and health innovation.

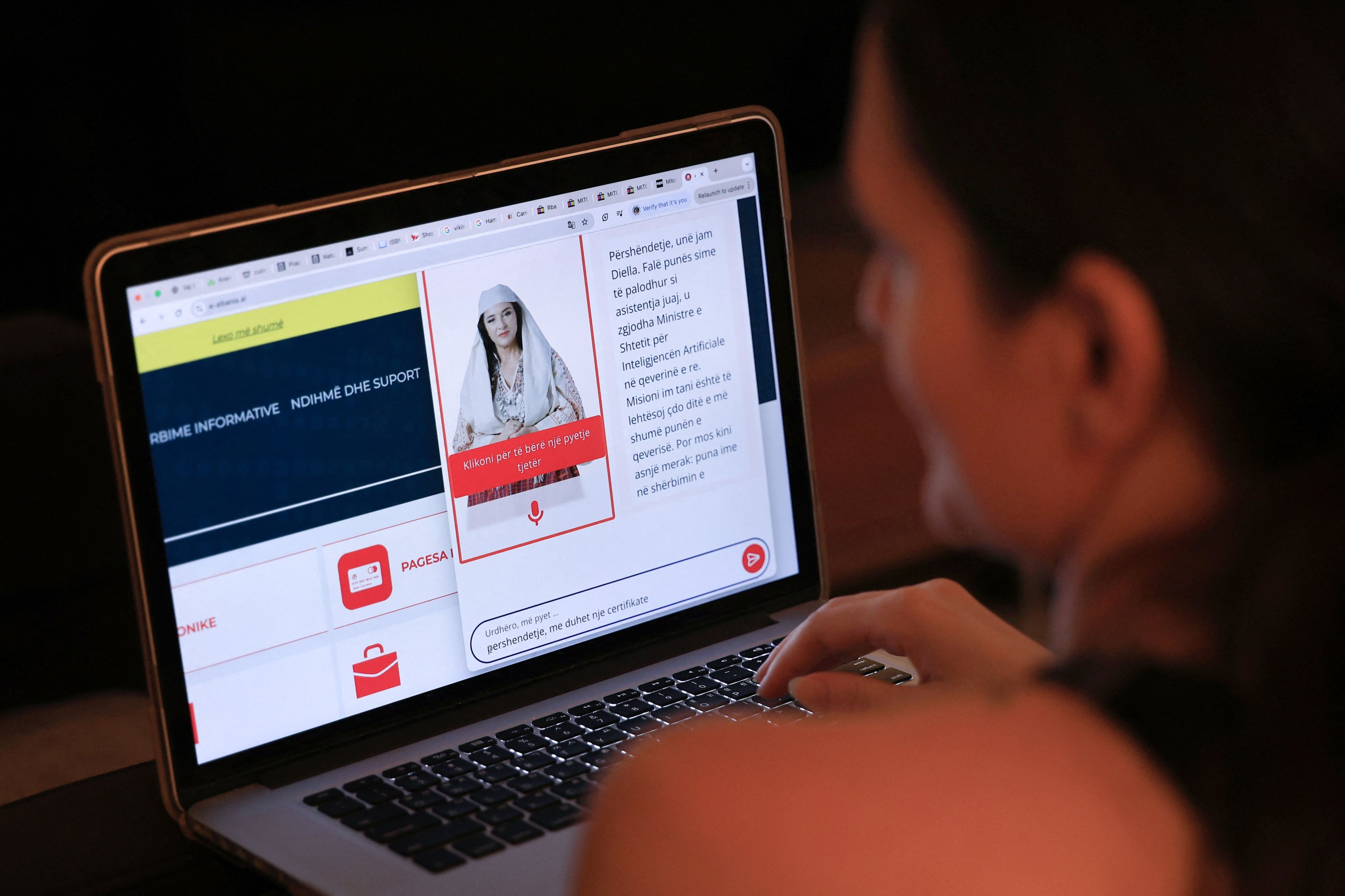

Fintech once again accounted for a substantial share of disclosed deals, reflecting the sector’s entrenched position at the centre of Africa’s start-up ecosystem. Payments platforms, digital banking services and cross-border remittance solutions have continued to attract backing, particularly in markets including Nigeria, Kenya, Egypt and South Africa. Investors cite strong demographic fundamentals, rising mobile penetration and persistent gaps in financial inclusion as structural drivers of growth.

Climate-focused ventures also featured prominently in January’s funding rounds. Start-ups working on distributed renewable energy, electric mobility, agri-tech and carbon management solutions secured capital as global investors sharpened their focus on sustainability-linked returns. Africa’s exposure to climate risk, combined with vast renewable energy potential, has positioned the continent as a testing ground for scalable green solutions. Development finance institutions and impact funds remain active participants in these transactions, often providing blended finance structures that combine concessional and commercial capital.

Debt financing formed a meaningful component of the $174 million total, underscoring a shift in capital structures. Venture debt and structured lending have become more common as founders seek alternatives to equity dilution at compressed valuations. Lenders, including specialist venture debt providers and development banks, have stepped in to support revenue-generating start-ups with clearer paths to profitability.

Geographically, the funding landscape continues to be concentrated in a handful of established hubs. Nigeria retained its position as a leading destination for venture capital, supported by its large consumer base and maturing technology ecosystem. Kenya maintained momentum in climate tech and fintech, while Egypt’s start-up scene benefited from strong local investor participation and growing regional expansion strategies. South Africa, with its comparatively developed capital markets, remained a key player in later-stage rounds and enterprise technology investments.

Early-stage funding showed signs of resilience despite the broader funding reset. Seed and pre-Series A rounds accounted for a sizeable portion of announced transactions, suggesting that investors remain willing to back strong founding teams with credible business models. However, ticket sizes have moderated, and due diligence processes have become more stringent. Investors are placing greater emphasis on unit economics, governance standards and clear revenue visibility.

Market observers note that Africa’s venture capital environment is increasingly shaped by global macroeconomic factors. Higher interest rates in developed markets over the past two years reduced liquidity and recalibrated risk appetite among international funds. As monetary policy in major economies begins to stabilise, some analysts expect capital flows to emerging markets, including Africa, to regain momentum, albeit selectively.

Local capital pools are also expanding, though from a relatively low base. Pension funds and family offices in parts of Africa have begun exploring venture allocations, encouraged by regulatory reforms and a growing track record of exits. While headline-grabbing unicorn valuations have become rarer, strategic acquisitions and secondary transactions continue to provide liquidity pathways for early investors.

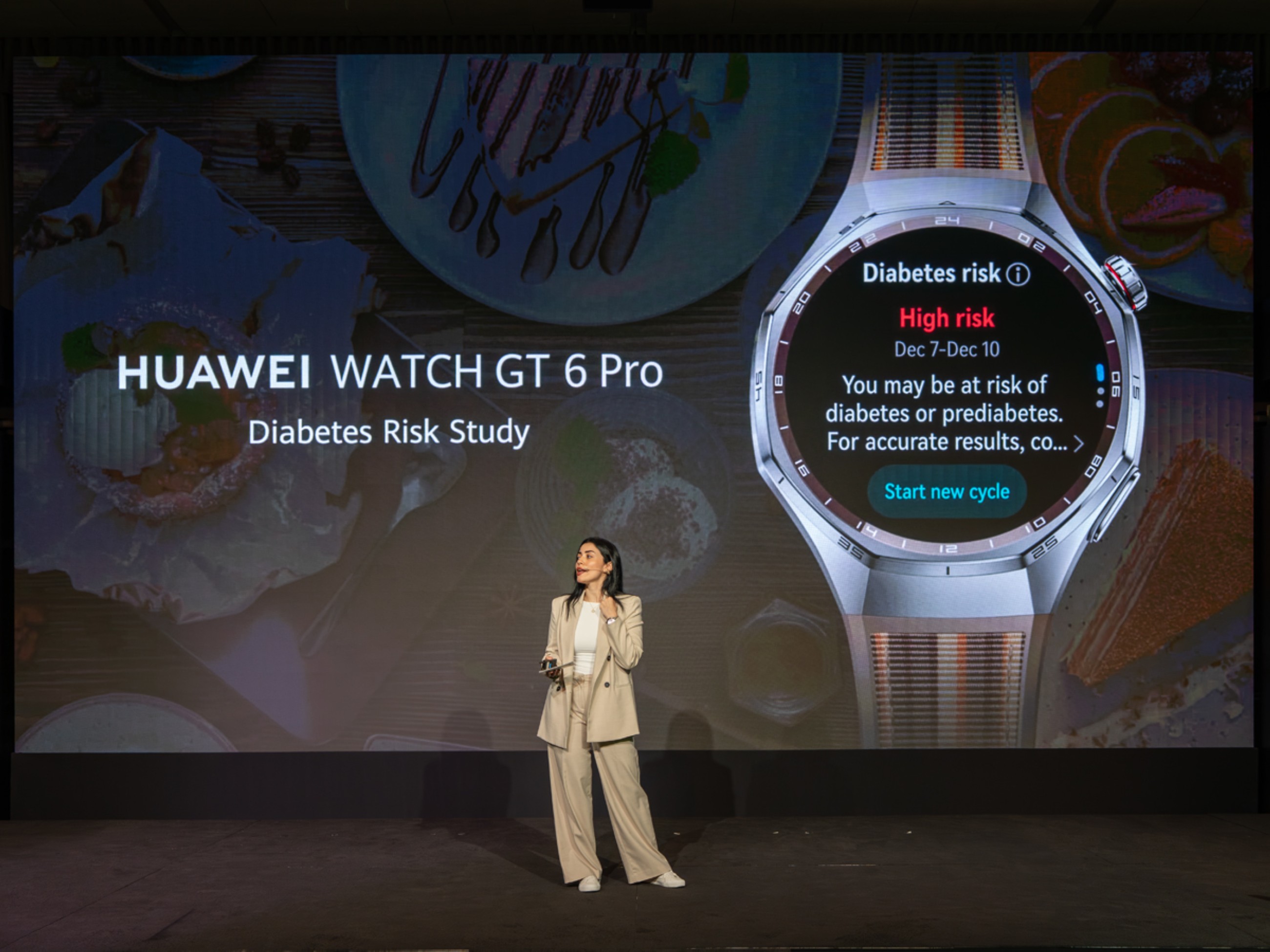

Sector diversification remains a defining theme. Beyond fintech and climate technology, January’s funding rounds included health-tech platforms improving access to diagnostics, ed-tech ventures leveraging mobile delivery models, and logistics companies addressing inefficiencies in fragmented supply chains. Digital commerce and software-as-a-service providers targeting small and medium-sized enterprises also secured backing, reflecting demand for productivity tools across the continent’s informal and formal sectors.

Founders have responded to the changed funding climate by prioritising cost discipline and sustainable growth. Lay-offs and restructuring exercises seen across the ecosystem in prior years have led to leaner operating models. Many start-ups are focusing on core markets rather than rapid multi-country expansion, aiming to consolidate market share before scaling further.

The article African start-ups secure $174mn in January appeared first on Arabian Post.

What's Your Reaction?